philadelphia wage tax calculator

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Pennsylvania. What is philadelphia city wage tax 2019.

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

The City of Philadelphia is a city built by entrepreneurs.

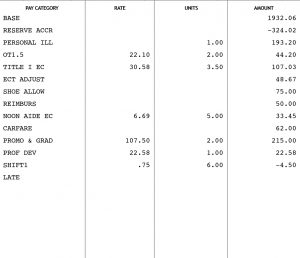

. Philadelphia Wage Tax Calculator. Employees who are non-residents of Philadelphia and work for employers in the city are subject to the Philadelphia Wage Tax at a rate of 35019. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The new NPT and SIT rates are applicable to income earned in Tax Year. Seconds until January 1st. Pennsylvania Hourly Paycheck Calculator.

Enter your info to see your take home pay. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Tax rate for nonresidents who work in Philadelphia. Medicare Tax is 145 of each employees taxable wages until they have earned 200000 in a given calendar year.

You must withhold 38712 of earnings for employees who live in Philadelphia. For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers. Weve recently updated the philagov website to include new easy-to-use content.

Living Wage Calculation for Philadelphia County Pennsylvania. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Once that earning amount surpasses 200000 the rate is.

Were building something new. Changes to the Wage and Earnings tax rates become effective July 1 2022. For example Philadelphia charges a local wage tax on both residents and non-residents.

Your average tax rate is 1198 and your marginal tax rate is 22. Your household income location filing status and number of personal exemptions. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

See where that hard-earned money goes - Federal Income Tax Social Security and. SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculating your Pennsylvania state income tax is similar to the steps we listed on our Federal.

Important note on the salary paycheck calculator. Residents of philadelphia pay a flat city income tax of 393 on earned income in addition to the. School Income Tax SIT.

How to use bir tax calculator 2022. 54 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. For calendar year 2022 for all taxes except Real Estate Tax and Liquor Tax interest is charged at the rate of 5 per year 042 of the unpaid balance per month.

This marginal tax rate. If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536. How Income Taxes Are Calculated.

Act 32 Local Income Tax Psd Codes And Eit Rates

Free Income Tax Preparation At Acana The Philadelphia Sunday Sun

Philadelphia County Pa Property Tax Search And Records Propertyshark

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

Occupational Employment And Wages In Philadelphia Camden Wilmington May 2021 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Pennsylvania Paycheck Calculator Smartasset

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Pennsylvania Paycheck Calculator Tax Year 2022

Free Pennsylvania Payroll Calculator 202 Pa Tax Rates Onpay

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

/woman-hand-working-with-calculator--business-document-and-laptop-computer-notebook--698971302-5b0a14d6eb97de0037e93638.jpg)

What To Do If You Make A Mistake On Your Canadian Tax Return

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

What Are Real Estate Transfer Taxes Forbes Advisor

Payroll Tax Services Philadelphia